estate tax exclusion amount sunset

This document contains amendments to the Income Tax Regulations CFR part 1 under sections 1471 through 1474 of the Code commonly known as the Foreign Account Tax Compliance Act or FATCA. 115-97 TCJA amended the basic exclusion amount.

Idaho State 2022 Taxes Forbes Advisor

In 2026 Tricias remaining exclusion amount sunsets to 5 million.

. After the application of subparagraph 1 the first annual exclusion amount of property transferred to or for the benefit of each donee during the 1-year period but only to the extent the transfer qualifies for exclusion from the United States gift tax under s. But the gift tax exclusion and estate tax exclusion are interconnected. About the Individual Income Tax.

In particular for decedents dying and gifts made after December 31 2017 and before January 1 2026 the basic exclusion amount is increased by 5 million to 10 million as adjusted for inflation. A For taxable years beginning after 1994 a tax is imposed on the South Carolina taxable income of individuals estates and trusts and any other entity except those taxed or exempted from taxation under Sections 12-6-530 through 12-6-550 computed at the following rates with the income. Enter the total amount of estimated tax payments made during the 2021 taxable year on this line.

Tax exempt refers to income earnings or transactions that are free from tax at the federal state or local level. Line 17 Withholding Form 592-B andor 593 Enter the 2021 nonresident or real estate withholding credit from Forms 592-B Resident and Nonresident Withholding Tax Statement or Form 593. Line 16 2021 Estimated Tax.

Over Subsidization in the Housing Choice Voucher Program - On September 28 2007 the Office of Inspector General OIG issued a report on over subsidization in the Housing Choice Voucher HCV program due to the issuance of vouchers with unit sizes greater than the. 2503b or c of the Internal Revenue Code as amended. 1 In all proceedings contesting the validity of a will the burden shall be upon the proponent of the will to establish prima facie its formal execution and attestation.

A self-proving affidavit executed in accordance with s. For purposes of this section payment of a charitable contribution which consists of a future interest in tangible personal property shall be treated as made only when all intervening interests in and rights to the actual possession or enjoyment of the property have expired or are held by persons other than the taxpayer or those standing in a relationship to the taxpayer described in. By funding a SLAT prior to the exclusion being lowered a donor will be able to utilize the historically high exclusion amount.

For example if you gift someone 20000 in 2021 you will have to file a gift tax return for 5000 which is the amount over the annual exclusion. PIH 2010-51 HA Issued. Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their states revenue department which will result in.

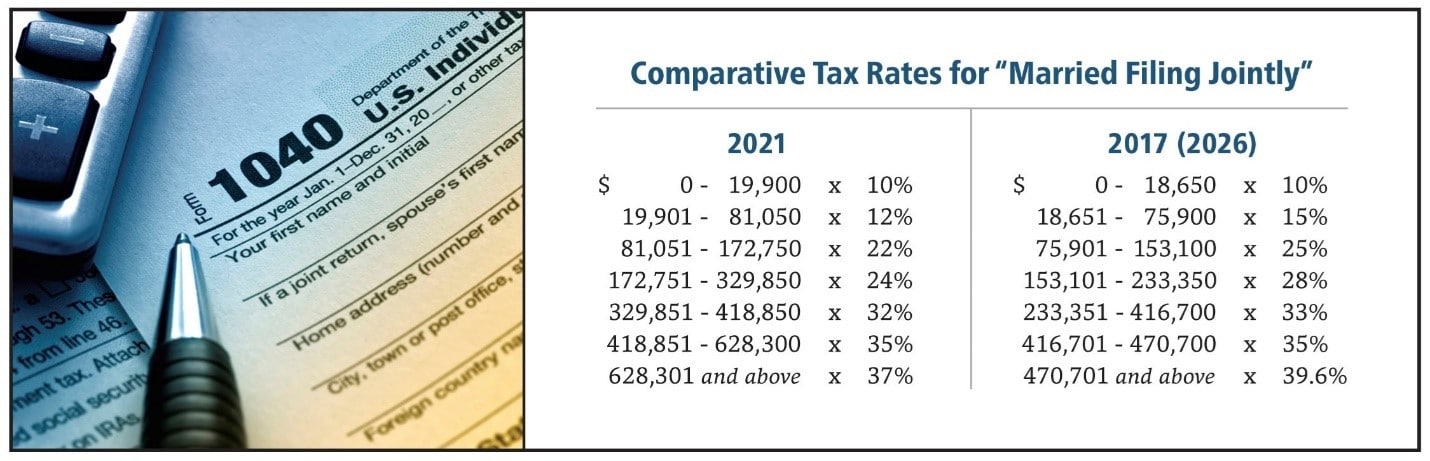

732503 or an oath of an attesting witness executed as required in s. At that time absent a new law ordinary income tax brackets will increase to pre-TCJA rates and the estate tax exemption will decrease to pre-TCJA levels. For purposes of this.

The current estate tax exclusion is 117 million in 2021 per person but is scheduled to sunset in 2026 if it is not changed sooner. The IRS and most states collect a personal income tax which is paid throughout the year via tax withholding or estimated income tax payments. Accordingly on these facts by engaging in SLAT planning now the couple would be able to exempt from the estate and gift tax an additional 606 million.

Consider the strategies below if your estate is. On March 18 2010 the Hiring Incentives to Restore Employment Act of 2010 Pub. When a taxpayer earns wages.

Had the couple not created the SLAT in 2020 and both died after the sunset at a time with the exemption was 6 million the total amount exempted from estate tax would be 12 million. 7332012 is admissible and establishes prima facie the formal execution and attestation of. The 2017 tax law commonly referred to as the Tax Cuts and Jobs Act Pub.

111147 the HIRE Act added chapter 4 of Subtitle A chapter 4. Plan for current tax laws to sunset by 2026 Tax changes implemented via the Tax Cuts and Jobs Act TCJA will expire at the end of 2025. The increase will sunset in 2025 at which point the exemption is set to be reduced to its pre-2018 level of 549.

References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code RTC. Elective Tax for Pass-Through Entities PTE and Credit for Owners For taxable years beginning on or after January 1 2021 and before January 1 2026 California law allows an entity taxed as a partnership or an S. Tax rates for individuals estates and trusts for taxable years after 1994.

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

9 Estate Planning Resolutions For The New Year Buckley Law P C

California Pass Through Entity Tax Overview

Filing An Arizona State Tax Return Credit Karma Tax

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Charitable Giving Incentives Plus Switcher Credit Tuscon Phoenix Az

Start Planning Now For A Higher Tax Environment Pay Taxes Later

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Qualified Opportunity Funds In Real Estate How To Invest Real Estate Investing Buying Investment Property Real Estate Buying

As The Tax Law Sunset Nears Review Savvy Gifting Solutions

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Burning Sunset Saguaro National Park Arizona Law Offices Of David L Silverman

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Tax Tips For Military Personnel With Income From Rental Properties Article The United States Army